Managing your money like a pro begins with effective budgeting tips that empower you to take control of your finances. For instance, whether you’re saving for a dream vacation or simply aiming to cover monthly expenses, a well-crafted budget serves as your roadmap to financial success. Therefore, in this guide, we’ll share actionable budgeting tips, real-world examples, and expert insights to help you master your money with confidence.

Why Budgeting Tips Are Essential for Financial Success

To begin with, budgeting isn’t just about restricting spending—it’s about aligning your money with your priorities. In fact, according to a 2023 survey by NerdWallet, 84% of Americans who follow a budget feel more in control of their finances. As a result, by adopting budgeting tips, you can reduce stress, build savings, and achieve milestones like buying a home or paying off debt.

Top Budgeting Tips to Manage Your Money Like a Pro

Next, here are 10 practical budgeting tips to help you take charge of your finances:

1. Set Clear Financial Goals

Firstly, budgeting tips are most effective when tied to specific objectives. For example, want to save for a vacation or pay off student loans? Define your goals and assign timelines. To illustrate, Sarah, a 28-year-old teacher, set a goal to save $5,000 for a trip to Europe in 18 months. Consequently, by allocating $278 monthly, she hit her target without stress.

- Short-Term Goals: Emergency fund, small purchases

- Long-Term Goals: Retirement, home down payment

2. Use the 50/30/20 Rule

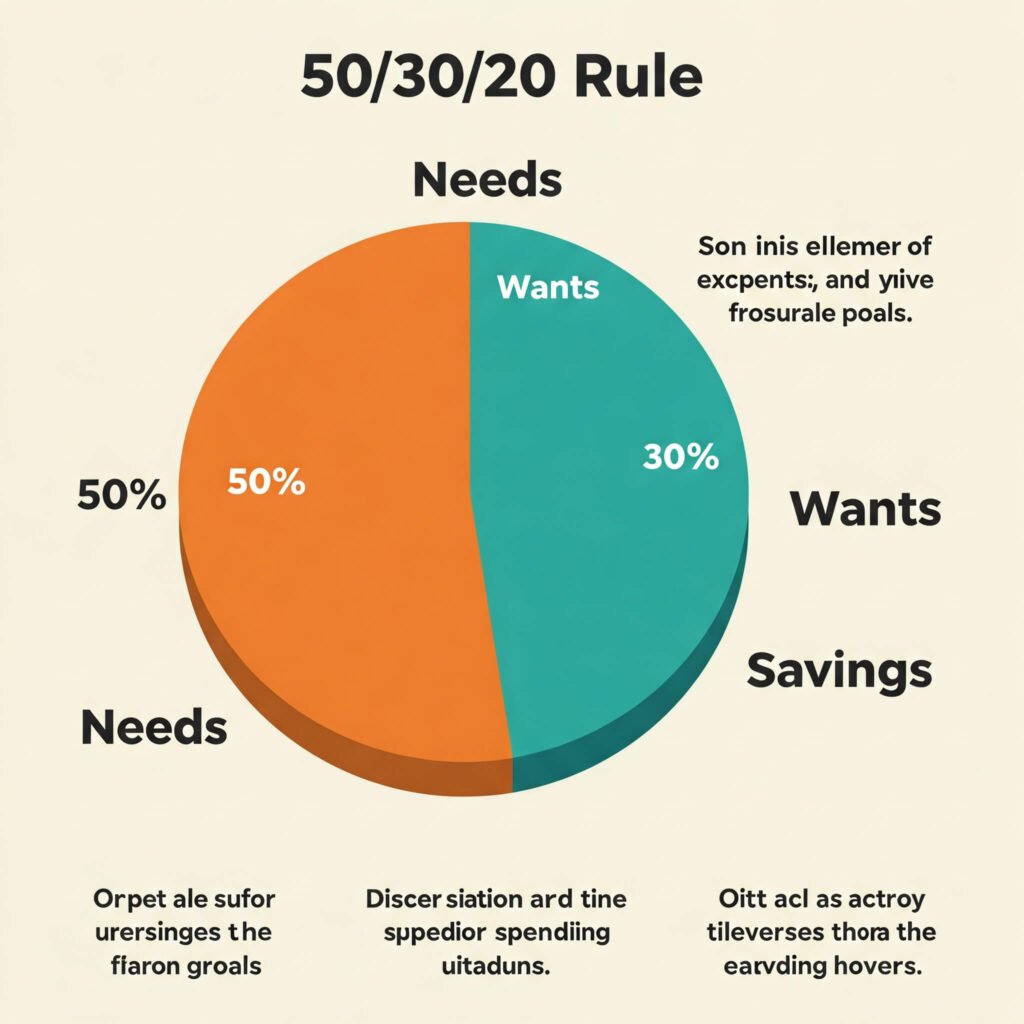

Moreover, the 50/30/20 budgeting rule is a simple yet powerful budgeting tip. Allocate:

- 50% of income to needs (rent, groceries)

- 30% to wants (dining out, hobbies)

- 20% to savings and debt repayment

For instance, if you earn $3,000 monthly, $1,500 goes to essentials, $900 to lifestyle, and $600 to savings or debt.

3. Track Your Spending

Additionally, you can’t manage money without knowing where it goes. Thus, use apps like Mint or YNAB to monitor expenses. To clarify, John, a freelance designer, discovered he spent $200 monthly on coffee shops. As a result, by cutting back to $50, he saved $1,800 annually.

- Review bank statements weekly

- Categorize expenses (e.g., utilities, entertainment)

4. Create a Realistic Budget

Furthermore, a budgeting tip that fails is one that’s too strict. Hence, build a budget that reflects your lifestyle while prioritizing savings. Use a spreadsheet or budgeting app to list income and expenses. Also, adjust as needed to avoid overspending.

Pro Tip: Include a small “fun fund” to enjoy guilt-free treats.

Advanced Budgeting Strategies for Long-Term Success

5. Automate Your Savings

In addition, automating transfers to savings accounts ensures you prioritize financial goals. Specifically, set up a recurring transfer the day after payday. According to Bankrate, 65% of savers who automate contributions are more likely to stick to their plan.

6. Cut Unnecessary Expenses

Similarly, review subscriptions and recurring costs. For example, cancel unused gym memberships or streaming services. To demonstrate, Maria saved $240 yearly by switching to a family-shared Netflix plan.

- Audit subscriptions monthly

- Negotiate bills (e.g., internet, phone)

7. Build an Emergency Fund

Moreover, unexpected expenses can derail your budget. Therefore, aim for 3-6 months of living expenses in an emergency fund. To start, save $500 to cover minor emergencies like car repairs.

Common Budgeting Mistakes to Avoid

8. Ignoring Small Expenses

On the other hand, small purchases add up. For instance, a $5 daily coffee habit costs $1,825 yearly. Thus, track these expenses and redirect savings to your goals.

9. Not Adjusting Your Budget

Likewise, life changes—job switches, rent increases, or new goals—require budget updates. Hence, review your budget quarterly to stay on track.

10. Forgetting to Reward Yourself

Finally, budgeting tips shouldn’t feel punitive. Instead, celebrate milestones, like paying off a credit card, with a small treat to stay motivated.

Tools to Help You Master Budgeting Tips

To enhance your budgeting, consider these tools:

- Spreadsheets: Google Sheets or Excel for custom budgets

- Apps: Mint, YNAB, or PocketGuard for real-time tracking

- Books: “The Total Money Makeover” by Dave Ramsey for inspiration

Additionally, explore these resources to find what suits your style. For more tools, check Investopedia’s budgeting guide.

Conclusion: Start Managing Your Money Like a Pro Today

In conclusion, budgeting tips are your key to financial freedom. By implementing strategies like setting goals, tracking spending, and using the 50/30/20 rule, you can manage your money with confidence. So, start small, stay consistent, and watch your financial dreams become reality. Ready to take control? Create your budget today and share your progress in the comments!

Outbound links: