Checking accounts are like your money’s crash pad—where your paycheck lands, bills get paid, and Choosing a Checking Account you swipe for late-night burritos. I learned this the hard way when I bounced a check at a taco stand—super embarrassing. They come in all sorts: basic, interest ones, online-only, whatever. Bank rate’s got a dope breakdown. I’m sitting here, rain fuzzing my window, thinking, “Why’s this be so tricky?” Love the no-fee dream, but hate how some accounts hit you with fees outs nowhere. My head’s spinning trying to pick one.

Types of Checking Accounts and Why They Stress Me Out

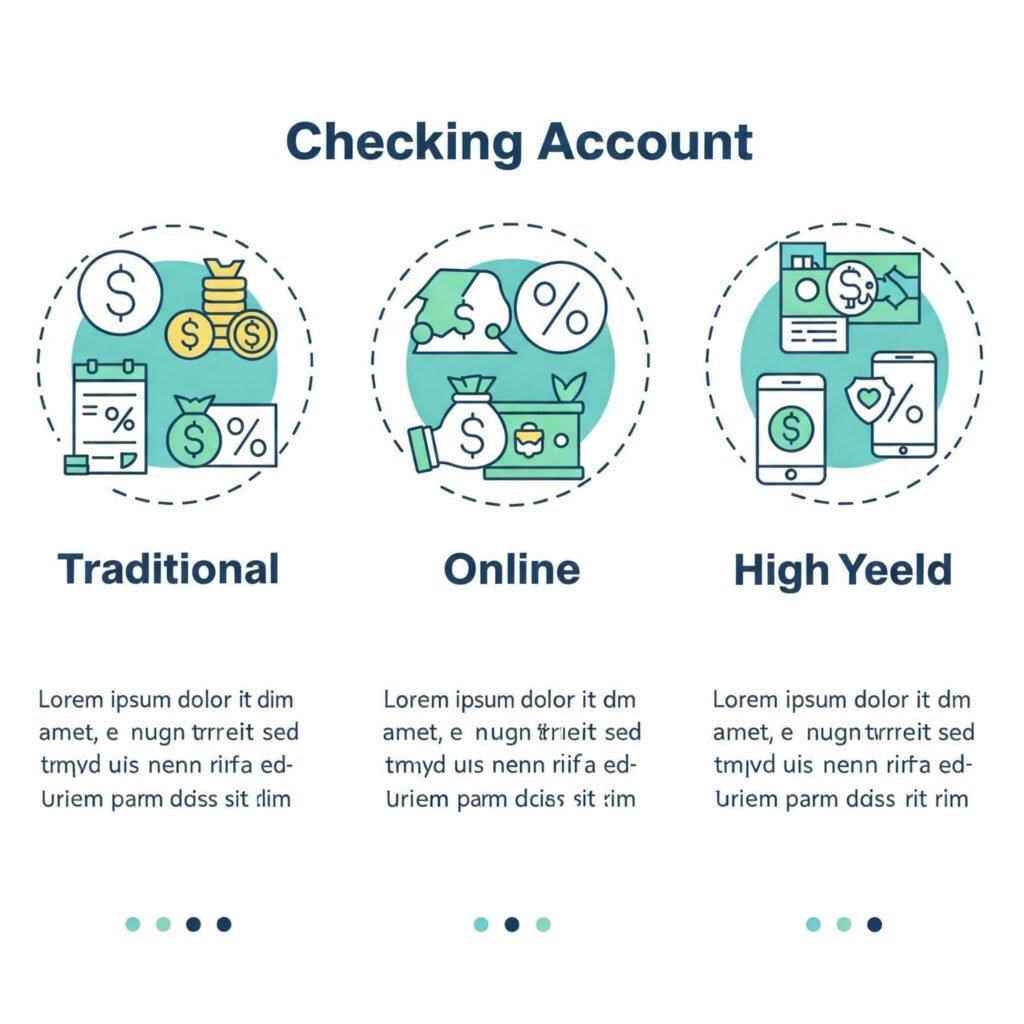

There’s a ton of checking accounts, and I’ve fumbled through a few, screwing up big time. Here’s the deal:

- Basic Checking: No bells or whistles, low or no fees. Good for broke folks like me, but zero perks.

- Interest-Bearing Checking: Earns a bit of cash, but you need a fat balance. Tried it, didn’t have enough dough—whoops.

- Online-Only Checking: No branches, cheap fees, but you gotta vibe with apps. I’m half-decent with that.

- Student Checking: Free for young peeps. Wish I knew about this in college, damn.

Nerd Wallet’s got a good guide on this. I’m torn—dig online banking’s ease, but miss real tellers when my app crashes.

My Total Checking Account Faceplant

So, picture this: Last fall, my kitchen’s a disaster—sticky floor from spilled cola, cat staring like I’m a deadbeat. I’m checking my account on my phone, thinking I’m golden, then bam—$35 overdraft fee ‘cause I forgot about a Spotify sub. Tried to buy coffee, card got declined, barista gave me the side-eye. Switched to an online-only checking account to dodge fees, but I botched the app setup and locked myself out for two days. Told my buddy over beers, and he’s like, “Bro, you forgot your balance?” Yup, I’m a train wreck. That moment, rain hammering, cat judging, taught me checking accounts need constant babysitting.

My Kinda Janky Tips for Picking a Checking Account

Here’s what I figured out, but I’m no guru, so maybe don’t bet your rent on this:

Talk to someone: Too stubborn to get help, but Motley Fool says advisors can save you.

Watch for fees: Overdraft and monthly fees are the worst. Got burned bad, so check the fine print.

Think about access: Need ATMs or tellers? Online-only’s cool but not if you suck at apps like me.

Check perks: Some accounts got cashback or interest. Forbes lists some good ones.

Mobile banking: Make sure the app’s solid. I use Chase’s, it’s pretty smooth.

[Outbound Link: Learn more about online banking benefits at Chime’s official site.]

Common Mistakes to Avoid When Choosing a Checking Account

To make the best choice, steer clear of these pitfalls:

- Ignoring Fees: Small fees add up. Always read the fine print.

- Overlooking Online Options: Online banks often have better rates and lower fees.

- Not Comparing Features: Don’t settle for the first account you find. Shop around.

- Skipping Reviews: Check customer reviews to avoid banks with poor service.

Actionable Tips for Choosing the Best Checking Account

Ready to find your perfect checking account? Follow these steps:

- Assess Your Needs: Do you need in-person banking or prefer online? How often do you use ATMs?

- Compare at Least Three Options: Use tools like NerdWallet or Bankrate to compare fees and features.

- Check for Bonuses: Some banks offer sign-up bonuses (e.g., $200 for opening an account with direct deposit).

- Test the App: Download the bank’s app to ensure it’s intuitive.

- Ask About Hidden Fees: Contact customer service to clarify any unclear terms.

Wrapping Up This Checking Accounts Rant

Man, I’m beat. Checking accounts are like picking a beer—simple ‘til you see a million options and pick the wrong one. Here in Portland, rain’s still going, my cat’s hogging my lap, and I’m hopeful but also dreading my next bank alert. I’m no money wizard—just a dude who bought beer instead of checking his balance—but picking a checking account’s doable. Check out Bank rate or Nerd Wallet, scope some accounts, and don’t be me with the overdraft drama. Yo, what’s your checking account screw-up? Drop it below, I’m all ears.

[Outbound Link: Find top checking accounts for 2025 at NerdWallet.]

[Outbound Link: Compare checking account fees at Bankrate.]