Yo, home equity loans vs personal loans are like choosing between a craft IPA or a cheap lager while I’m chilling in my drizzly Portland apartment, surrounded by empty kombucha bottles and a laptop that’s one coffee spill from doom. Just last month, I took out a personal loan to fix my car, thinking I was slick, only to learn a home equity loan might’ve saved me thousands – I was legit shook, staring at my bank app like it was a horror flick. The air smells like wet pine and regret, and I’m spilling the tea on home equity loans vs personal loans. I’m no finance bro – my budget’s more like a bad open mic night – but I’ve learned the hard way which loan might fit your vibe. Home equity loans vs personal loans are a wild choice, and I’m dropping my raw, messy, sometimes contradictory thoughts from my Pacific Northwest chaos. Let’s navigate this money maze together. Insurance Coverage 101: How to Make Sure You’re Fully Protected

My Loan Fiasco Comparing Home Equity Loans vs Personal Loans

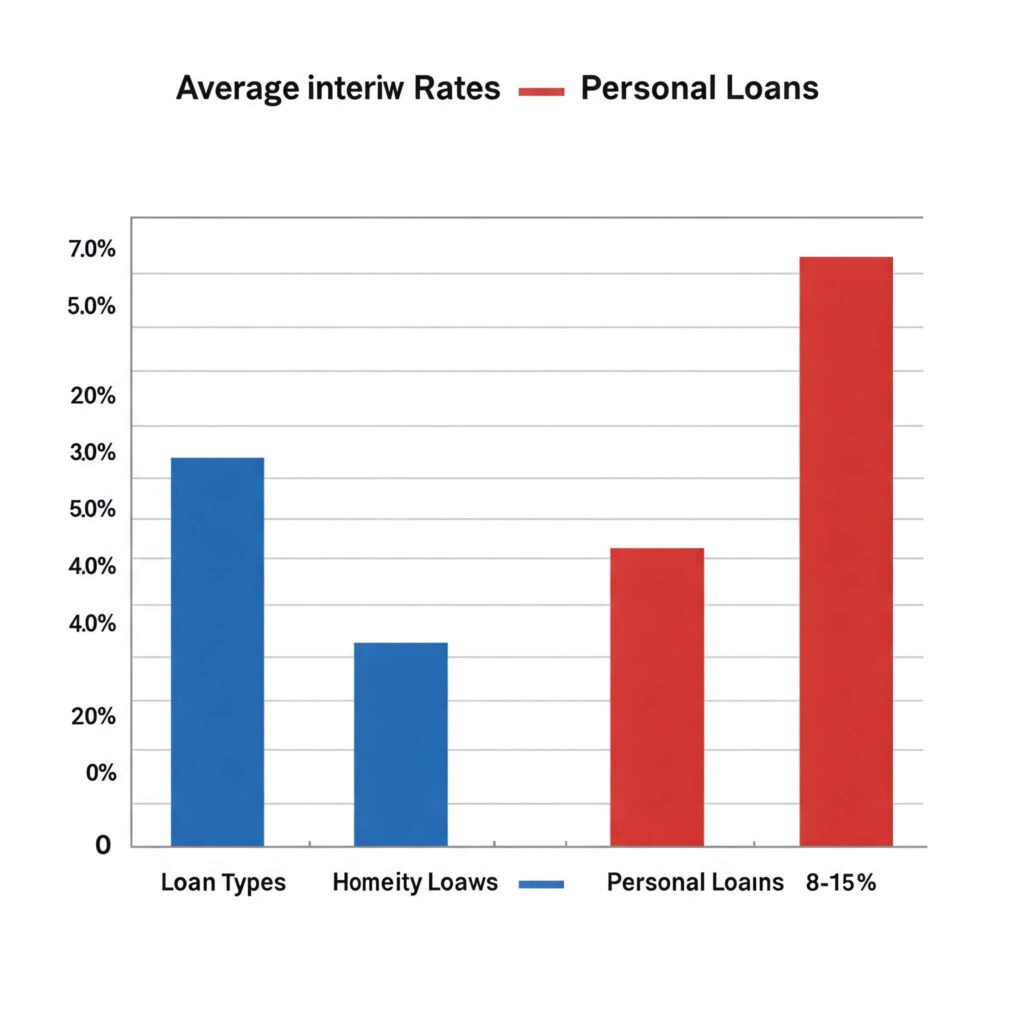

Picture this: I’m at a Hawthorne food cart, dodging vegans and scrolling X, when I see a post about home equity loans – home equity loans vs personal loans became my obsession. I went with a personal loan ‘cause it was quick, but NerdWallet says home equity loans often have lower rates ‘cause your house is collateral. I felt like a genius until I realized I was paying 10% interest when I could’ve tapped my home’s equity at 6% – total clown move. Forbes notes personal loans are unsecured, so they’re easier but pricier. Home equity loans vs personal loans feel like a financial fork in the road, and I’m torn – I love quick cash but hate risking my crib. Like, seriously, why’s this so tricky?

Why Home Equity Loans Shine in Home Equity Loans vs Personal Loans

Diving into loans, home equity loans are like the VIP pass for low rates. I was hyped to refinance my car repair debt, but my buddy said home equity loans could’ve cut my interest in half ‘cause my Portland bungalow’s got value. Investopedia explains they use your home as collateral, which means better terms but higher stakes. I bragged about my “loan hack” to my neighbor, then realized I didn’t have enough equity yet – oops. Borrowing against home equity is clutch, but I’m learning while sweating through my flannel, wondering if I’ll screw it up again. It’s this mix of “hell yeah, savings!” and “ugh, I’m a mess!” that keeps me up.

My Dumb Mistakes

Man, home equity loans vs personal loans expose my worst fumbles. I rushed into a personal loan without checking my home’s equity, thinking it was easier, then learned I’d paid $200 extra in interest – I was freaking out, checking my app in a rainy park. CNBC reports that personal loans have shorter terms, which can trap you with high payments, and I felt that sting. My contradictory vibe? I want low payments but hate tying my house to debt. Tip from my mess: calculate your home’s equity first – don’t be me, signing papers while chugging cold brew.

Why Flexibility Matters in Home Equity Loans vs Personal Loans

Zooming in on home loans, flexibility is a game-changer. I’ve been obsessively checking loan apps from my porch, with Portland’s drizzle mocking my broke vibes. CNET says personal loans are quicker to get but have shorter repayment terms, while home equity loans offer longer stretches.I picked a personal loan for speed, then struggled with $300 monthly payments. My advice? Match the loan term to your budget – it’s like picking the right hiking trail.

Choosing Between Home Loans in 2025

Peering into the future, home equity loans vs personal loans have me cautiously stoked, scribbling notes while food cart smells waft through my window. Bankrate notes that 2025 is bringing lower home equity rates, which is dope for homeowners like me. I’m dreaming of smart borrowing, but scared I’ll botch it with another rushed choice. Home equity loans vs personal loans are evolving, and I’m ready to level up, even if my bank account’s whimpering.

Tips for Picking Between Home Equity Loans vs Personal Loans

Here’s my shaky playbook for choosing a loan type:

- Check equity: Use Bankrate to estimate your home’s value – saved me from a bad call.

- Compare rates: Home equity loans are often cheaper, but check both.

- Match terms: Pick a loan term you can handle monthly.

- Stay informed: NerdWallet has killer loan comparisons.

Anyway, that’s my raw take on home loans – messy, human, and full of my screw-ups. I’m just trying to borrow smart while dreaming of financial freedom. Got loan tips or borrowing horror stories? Hit up Forbes for more or drop a comment – let’s swap tales over virtual craft beer.