Okay, so a diversified investment portfolio is like trying to juggle flaming torches while riding a unicycle in my cramped Seattle apartment—half the time I’m dropping something, and it’s usually my dignity. I’m slouched on my sagging couch right now, rain smacking the window like it’s mad at me, the faint whiff of burnt toast from my earlier kitchen fail lingering, and I’m thinking about how I totally botched my first investments but somehow stumbled into something decent. Like, for real? I’m just a regular dude in the US, not some Wall Street bro, and I’ve made every dumb move in the book—chasing hyped stocks, ignoring bonds, you name it. Here’s my sloppy, human, sometimes contradictory take on building a diversified investment portfolio for long-term success, straight from my coffee-stained notebook. It’s not perfect, and neither am I—let’s dive in.

My Big Oops with a Diversified Investment Portfolio: Why It Matters

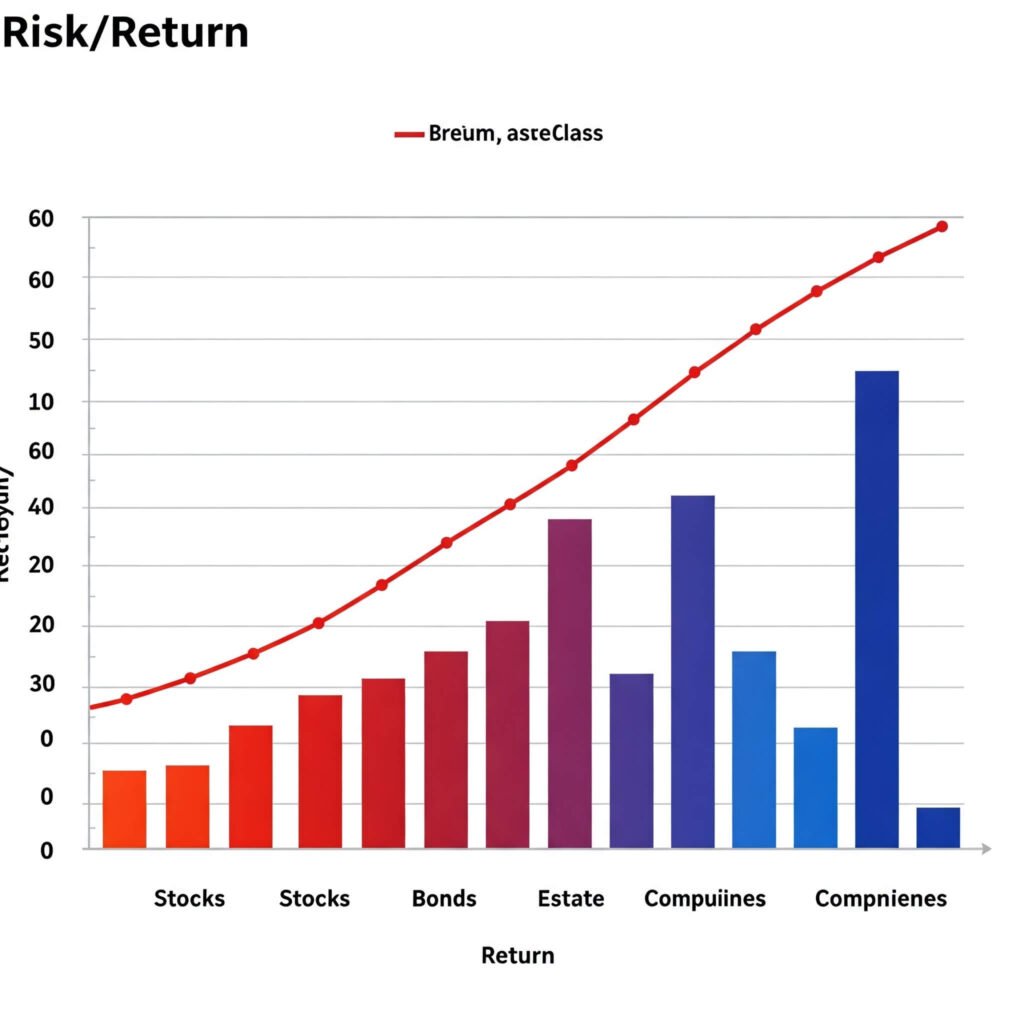

Man, I learned diversified investment portfolios the hard way, like burning your tongue on too-hot pizza. Last year, I went all-in on some tech stock after seeing X posts hyping it to the moon. Picture me in a grungy Seattle coffee shop, smugly sipping an overpriced latte, checking my phone, then choking when I saw a 25% drop. Total facepalm. Investopedia says spreading risk across assets is key and I wish I’d paid attention. Now I mix stocks, ETFs, and bonds to avoid those gut-punch moments, tho I still get tempted by shiny stuff.

It’s like, you gotta balance growth with not losing your shirt. I started with S&P 500 ETFs—NerdWallet swears by them for long-term wins. I’m still a bit reckless, like sneaking in some crypto bets (whoops), but I keep it under 5% now. No more latte-choking disasters.

Savings accounts: High-yield ones at like 4.8% APY for emergencies.

ETFs: Cheap, diversified, my lazy-day fave.

Stocks: A few for growth, but don’t go wild.

Asset Allocation in a Diversified Investment Portfolio: My Messy Approach

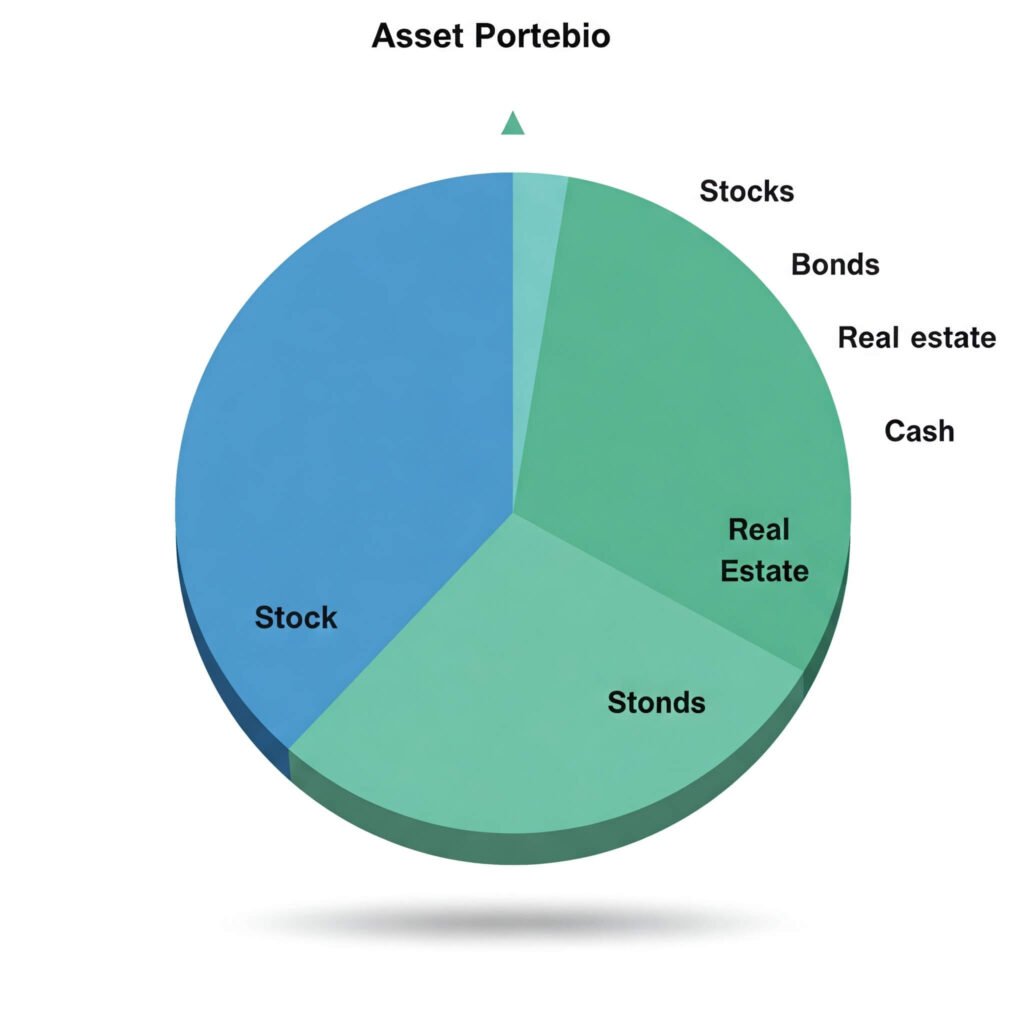

Figuring out asset allocation for a diversified investment portfolio is like picking a playlist for a road trip—too many choices, and I always pick a few duds. I’m staring at my desk, littered with old Post-its and a dying cactus, and I’m laughing at how I used to just throw cash at whatever sounded cool. Big oof. Fidelity says mix assets based on your goals and risk vibe . I aim for 60% stocks, 30% bonds, 10% weird stuff like gold, but I’m always tweaking it, sometimes too much.

Last summer, I got suckered into real estate crowdfunding—thought it’d spice up my portfolio. Spoiler: Fees killed me, and I felt like a total noob. But it pushed me to try bonds and TIPS, which Forbes calls solid for 2025. I’m still a bit all over the place, but I’m learning to chill and stick to a plan.

- Stocks: Tech and healthcare for growth, but they’re wild.

- Bonds: Municipal ones for tax breaks, super boring but clutch.

- Alternatives: A lil’ gold or REITs, but don’t overdo it.

Low-Risk Pieces for Your Diversified Investment Portfolio: Where I Got Smarter

Low-risk stuff in a diversified investment portfolio? I used to think that was for old-timers. Like, picture me last winter, wrapped in a blanket, scrolling X, thinking bonds were lame. Then my stocks crashed, and I was eating cereal for dinner for a week. Now I’m all about Treasury bonds and high-yield savings—Bankrate says they’re low-risk champs for 2025 . I’ve got some cash in a 5% APY account, and it’s like finding a parking spot downtown—small win, big relief.

Gold’s my other go-to. I bought a couple ounces after reading about inflation hedges, stashed it in a drawer with some old takeout menus—real classy, right? It’s up like 8%. I still dabble in crypto for the thrill, which is totally contradictory, but low-risk stuff keeps my diversified investment portfolio grounded.on strategy for moderate risk-takers.

Outbound Link: Morningstar Portfolio Tools

Hot Trends to Boost Your Diversified Investment Portfolio: My Surprises

Okay, I’m geeking out over trends for diversified investment portfolios. I was scrolling X the other night, rain blurring my view of the Space Needle, and saw chatter about AI and energy stocks popping off . J.P. Morgan’s hyping AI infrastructure for 2025 , so I grabbed a tech ETF. It’s up, but I’m paranoid it’ll tank—classic me, overthinking everything.

Biotech’s another surprise. Forbes says it’s a long-term winner , and I tried a biotech fund that dipped then bounced back. I also toss some cash into ESG funds ‘cause I wanna feel less guilty, even if the returns are meh sometimes. My big lesson? Mistakes hurt, but they teach you.

Numbered tips, ‘cause I’m extra:

- Peek at X for trends, but double-check with Investopedia (https://www.investopedia.com/).

- Automate investments—saves me from my own dumb impulses.

- Rebalance once a year; I forgot in 2024 and regretted it.

Outbound Link: Betterment Investing

Common Mistakes to Avoid in Portfolio Diversification

Even with a solid plan, pitfalls can derail your diversified investment portfolio. Watch out for:

- Over-Diversification: Holding too many assets can dilute returns and complicate management. Aim for 20-30 investments across asset classes.

- Ignoring Fees: High expense ratios in mutual funds can erode returns. Stick to funds with fees below 0.5%.

- Chasing Trends: Avoid overloading your portfolio with “hot” assets like meme stocks or cryptocurrencies without proper research.

- Neglecting Rebalancing: Failing to rebalance can expose you to unintended risks as market conditions shift.

Actionable Takeaways for Long-Term Success

- Start Small: Begin with index funds or ETFs to achieve instant diversification.

- Review Regularly: Check your portfolio quarterly and rebalance annually.

- Stay Disciplined: Stick to your strategy, even during market downturns.

- Seek Professional Advice: Consult a financial advisor for personalized guidance, especially for complex portfolios.

Outbound Link: Certified Financial Planner Board

Conclusion: Your Path to a Diversified Investment Portfolio

Building a diversified investment portfolio is a proven strategy for long-term financial success. By assessing your goals, allocating assets wisely, and avoiding common mistakes, you can create a portfolio that balances risk and reward. Start today, stay consistent, and watch your wealth grow over time.

So, that’s my hot mess of a guide to a diversified investment portfolio for long-term success, straight from a Seattle guy who’s spilled coffee on his budget and lived to tell the tale. It’s not perfect—I’m not either—but mixing stocks, bonds, and a dash of alternatives keeps me from losing it. Like, don’t be 2024 me, betting it all on one stock. Check out Fidelity’s tips

Outbound Link: Fidelity Investments