I screwed this up last year, went all-in on Traditional thinking I’d save big now, but with inflation screwing me over, I’m kicking myself for not picking Roth. Contribution limits for 2025 are $7,000 if you’re under 50 like me, or $8,000 if you’re older and playing catch-up. IRS has the full scoop, check their site.

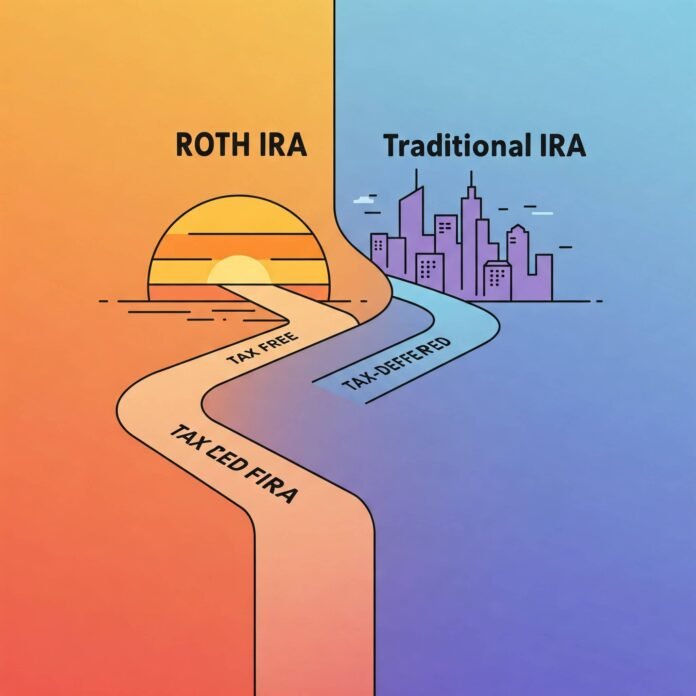

Eligibility’s where it gets tricky. Traditional IRA? Anyone with a paycheck can jump in, no income caps, though deductions phase out if you’re ballin’. Roth IRA vs. Traditional IRA, though—Roth’s got income limits. For singles in 2025, full contributions up to like $146,000 MAGI, then it phases out. I barely made the cut last year, felt like I won a prize, but with forms. hate how Roth cuts off high earners, but love the tax-free vibe. Contradictory? Yup, that’s me.

Pros and Cons: Why Roth IRA vs. Traditional IRA Messes with My Head

Here’s the lowdown, ‘cause my brain’s a dumpster fire without lists:

- Traditional IRA Pros: Tax break now—huge when I got that raise and shaved my taxes down. Grows tax-deferred, but RMDs hit at 73, forcing you to pull cash even if you don’t wanna. Sucks for legacy planning.

- Traditional IRA Cons: Withdrawals get taxed as income, could jack you into a higher bracket later. Worries me with Social Security in the mix.

- Roth IRA Pros: Tax-free growth and withdrawals—dreamy, like not owing a dime in retirement. No RMDs, so it grows forever. Perfect for my lazy self.

- Roth IRA Cons: Paying taxes now stings, especially when my heating bill ate my budget last winter.

I’m, like, torn daily. One minute I’m hyped for Roth’s tax-free future, next I’m clinging to Traditional’s instant relief. Vanguard says it’s all about current vs. future tax rates I played with Fidelity’s calculator while eating cold pizza, totally shifted my vibe. But, real talk, I’m still second-guessing.

My Cringe-Worthy Roth IRA vs. Traditional IRA Story

So, picture me in early 2024, kitchen a mess—takeout boxes everywhere, fridge buzzing like it’s judging my life choices. I decide to finally get serious about retirement. Went Traditional IRA, maxed it out, felt like a finance bro. But tax season hit, and I realized my income’s creeping up, so future withdrawals might get taxed to hell. Whoops. Switched to Roth halfway, lost some deduction juice. Told my buddies over beers, and they roasted me: “You swapped IRAs like underwear?” Yup, guilty as charged. That flip-flopping taught me Roth IRA vs. Traditional IRA ain’t a one-way street. If you’re young-ish like me, expecting taxes to climb (thanks, economy), Roth’s your jam. It’s like that first sip of coffee on a rainy Seattle morning—warm, hopeful, but you might burn your tongue rushing in.

Learned a ton from Motley Fool posts, ignoring my laundry pile.Weirdly, I got stoked about compound interest, nerding out on how $7k could grow. But, raw honesty? Some days I’m like, “Will I even retire with this gig economy nonsense?” Total contradiction, I know.

My Kinda Messy Tips for Roth IRA vs. Traditional IRA

From my fumbles, here’s some advice—take it with a pinch of salt, I’m no expert:

- Check your tax bracket now vs. later. Lower now? Go Roth IRA vs. Traditional IRA for the upfront hit.

- Max it out yearly—2025 limits are $7k/$8k. I slept on it in 2023, don’t be me.

- Maybe split between both? Tried it, got messy. Prudential’s got a good breakdown.

- Roth income limits suck—look into backdoor Roth if you’re over, but I bailed, too complex.

- Use Schwab’s calculator, ran my numbers during a 2 a.m. panic, super helpful.

I know, all over the place, but don’t overthink it—just start. My biggest tip? Talk to a fiduciary advisor, ‘cause I almost tanked it solo.der 50).

Wrapping Up This Roth IRA vs. Traditional IRA Rant

I’m leaning Roth for that tax-free goodness, especially staring out at this foggy Seattle view, dreaming of chill retirement vibes. But I’m a hot mess sometimes, so what works for me might not for you. Seriously, grab a coffee, crunch some numbers on those calculators, and maybe hit up a pro. What’s your vibe on Roth IRA vs. Traditional IRA? Share your screw-ups or thoughts below, let’s keep this chat real.

Outbound Link: For detailed IRA contribution limits, visit the IRS website.

Outbound Link: Learn more about Roth conversions at Investopedia.