Okay, so 401(k) retirement planning is like my financial lifeline, sitting here in my damp Seattle apartment on this rainy August 21, 2025, sipping coffee that’s, uh, kinda burnt ‘cause I forgot to clean the pot again. Back in my 20s, I totally blew off my first job’s 401(k). Retirement seemed like forever away. I was too busy freaking out over student loans and blowing cash on craft beer. Dumb move, me. That free employer match I ignored? Could’ve been a fat stack by now. Let’s dive into why 401(k) retirement planning is legit crucial to avoid my stupid mistakes.

My Messy Start with 401(k) Retirement Planning

Picture this: 2018, I’m crashing on a friend’s couch in Austin, Texas. Landed a marketing gig with a decent 401(k) match – 50% up to 6%. Sounded cool, but I half-assed it, picking funds ‘cause their names sounded edgy, like “Aggressive Growth”. Yeah, bad idea. The 2020 market crash hit, and I panicked, yanking my money out. Got slammed with taxes, eating cheap ramen in that muggy Texas heat. That screw-up showed me why tax-deferred growth in 401(k) retirement planning matters. The IRS has a solid breakdown here.

Now I try to max contributions,even if it means skipping fancy coffee. Seeing my balance grow? It’s like hearing fresh snow crunch under my boots. If you’re starting, don’t be dumb like me. Check your fund options. Start small, but start.

Why 401(k) Retirement Planning’s a Game-Changer

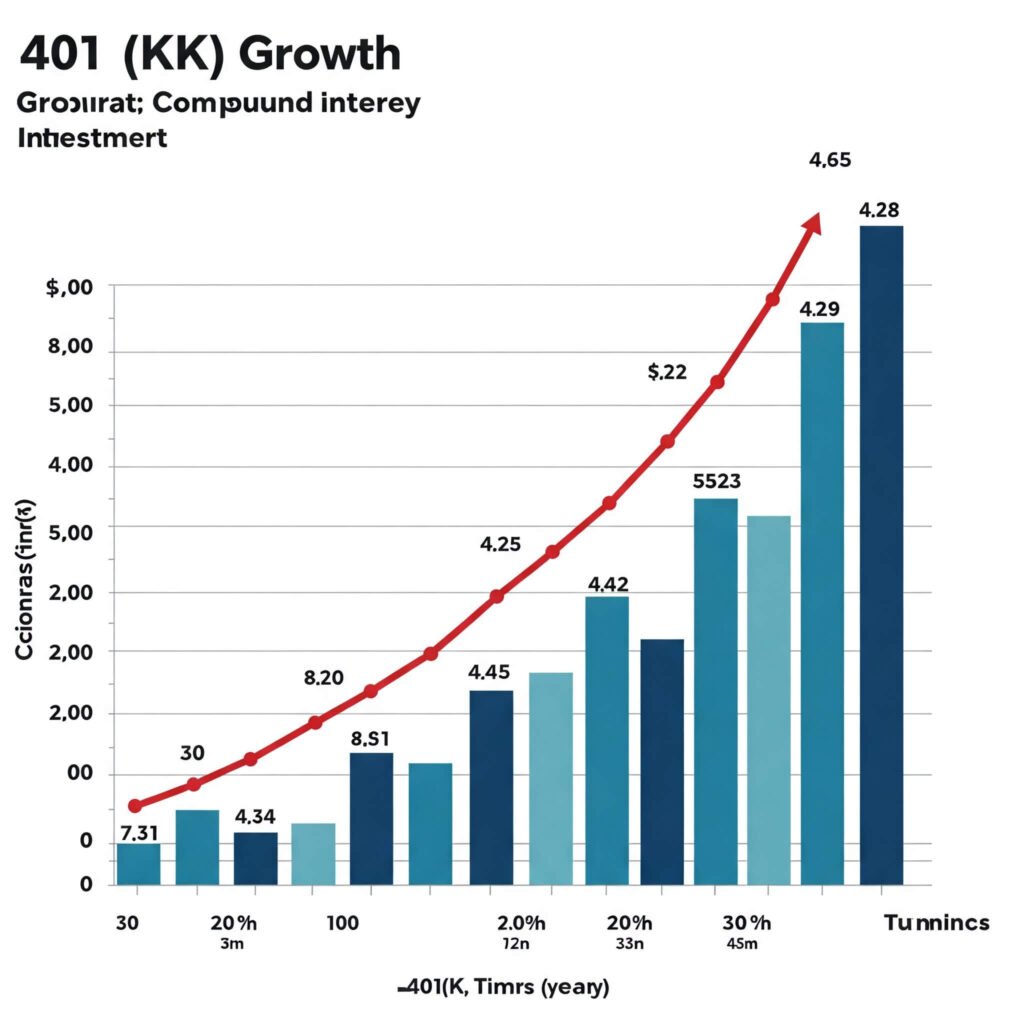

The employer match in 401(k) retirement planning is free money, like finding a twenty in your jeans. My job now matches dollar-for-dollar up to 4%. Last year, that was $2,500 extra, no effort. Almost lost it once when my car broke down on I-5, rain pouring, engine smoking like my bad decisions. I automate contributions now. Compound interest is magic.

Tax perks rock too. Traditional 401(k)s cut your taxes now. Last year, that funded a quick Oregon coast trip – salty air, crashing waves. I’m trying Roth 401(k) too, ‘cause taxes might climb later. Still second-guess that choice sometimes. Fidelity’s got calculators to help figure it out here.

Roll over old 401(k)s – I forgot one once, and fees ate it up.

Start with 1% if you’re nervous.

Mix up your investments; I got burned betting big on tech stocks.

Screw-Ups in 401(k) Retirement Planning I Barely Avoided

401(k) retirement planning ain’t all rosy. I borrowed from mine once for a “needed” kitchen gadget. Big regret. Missed out on growth, like stubbing my toe in the dark. Hidden fees suck too; I switched plans to save a couple hundred bucks a year. My biggest issue? Sticking with it. Vet bills for my dog, concert tickets – I’m tempted to slack. Inflation’s rough too. I’m still working on discipline in 401(k) retirement planning. Free advisors through work help; NerdWallet’s got tips here.

Wrapping Up My Ramble on 401(k) Retirement Planning

Wrapping Up My 401(k) Retirement Planning Rant

So yeah, from my rainy Seattle spot, 401(k) retirement planning’s gone from “meh” to my financial anchor. I’m not perfect – far from it – but starting early and staying consistent builds security. Check your 401(k) today, tweak it, feel good. What’s your next move? Tell me in the comments, I’m all ears.

Outbound links:

U.S. Census Bureau – Cited to support the statistic that only 56% of Americans have access to a 401(k).

Forbes – Referenced to note that 80% of large companies offer some form of employer match for 401(k) contributions.

Bankrate’s Compound Interest Calculator – Used to illustrate the example of how contributing $5,000 annually at a 7% return from age 25 could grow to over $1 million by age 65.

Vanguard’s Retirement Calculator – Recommended as a tool for readers to estimate their retirement needs and set goals.